HBI concludes an intense week at the POC 2026 in Kuala Lumpur

We extend our sincere thanks to the organizers and participants, as well as to all HBI–OLEOLINE clients and partners for their trust and support during our plenary session on Tuesday, 10 February, where we presented our latest Oleochemical Market Outlook.

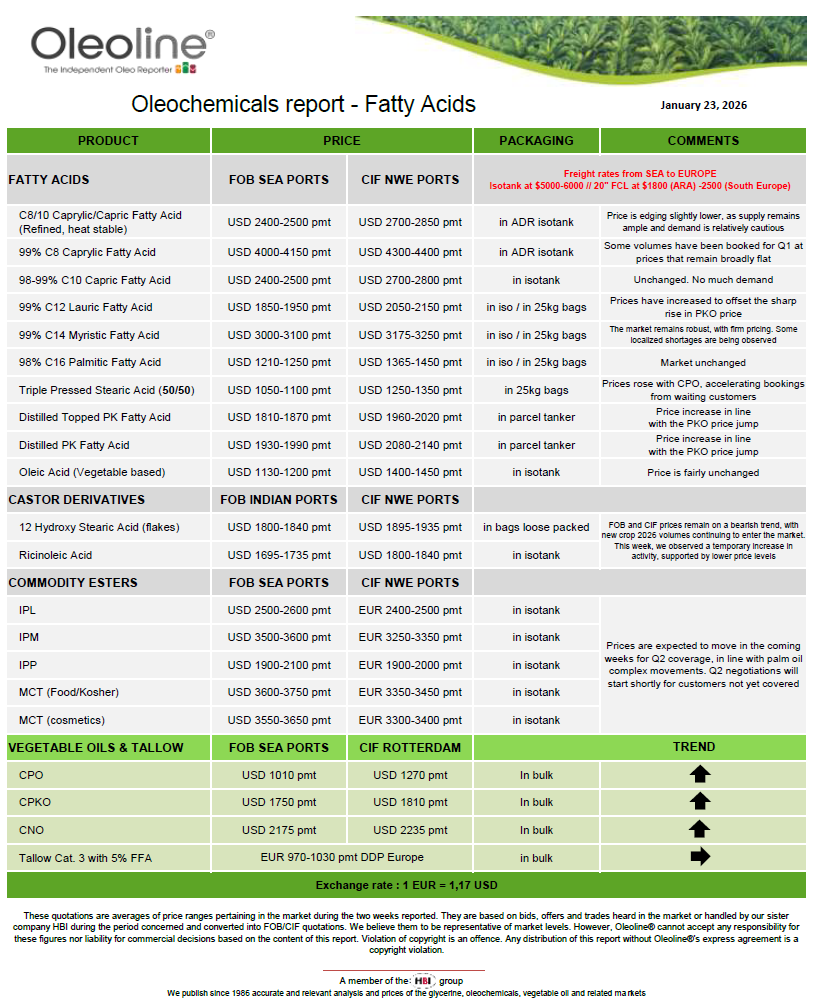

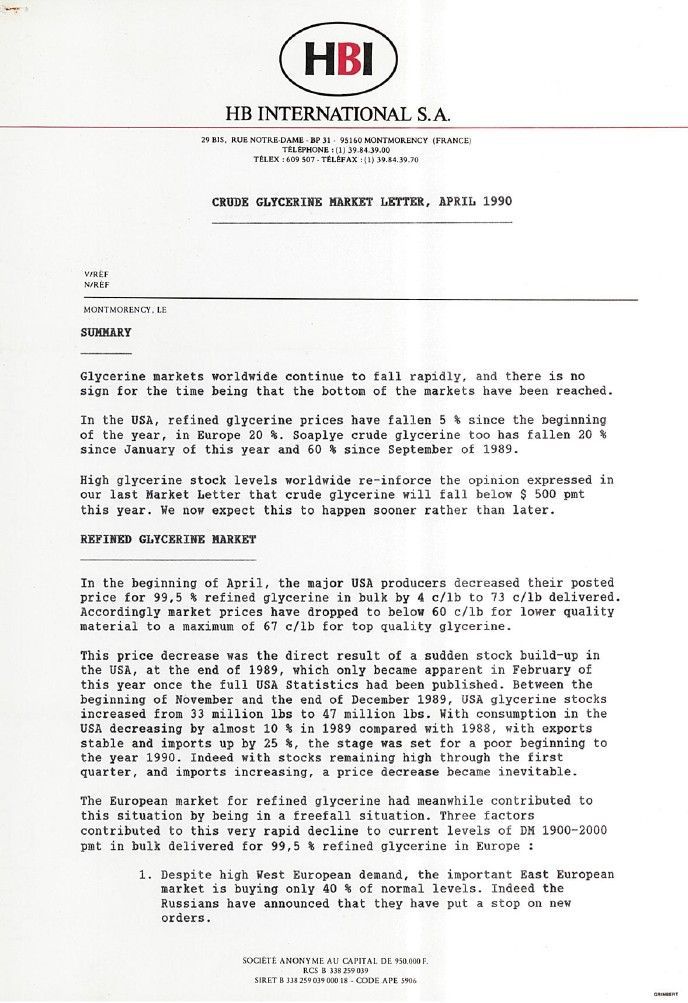

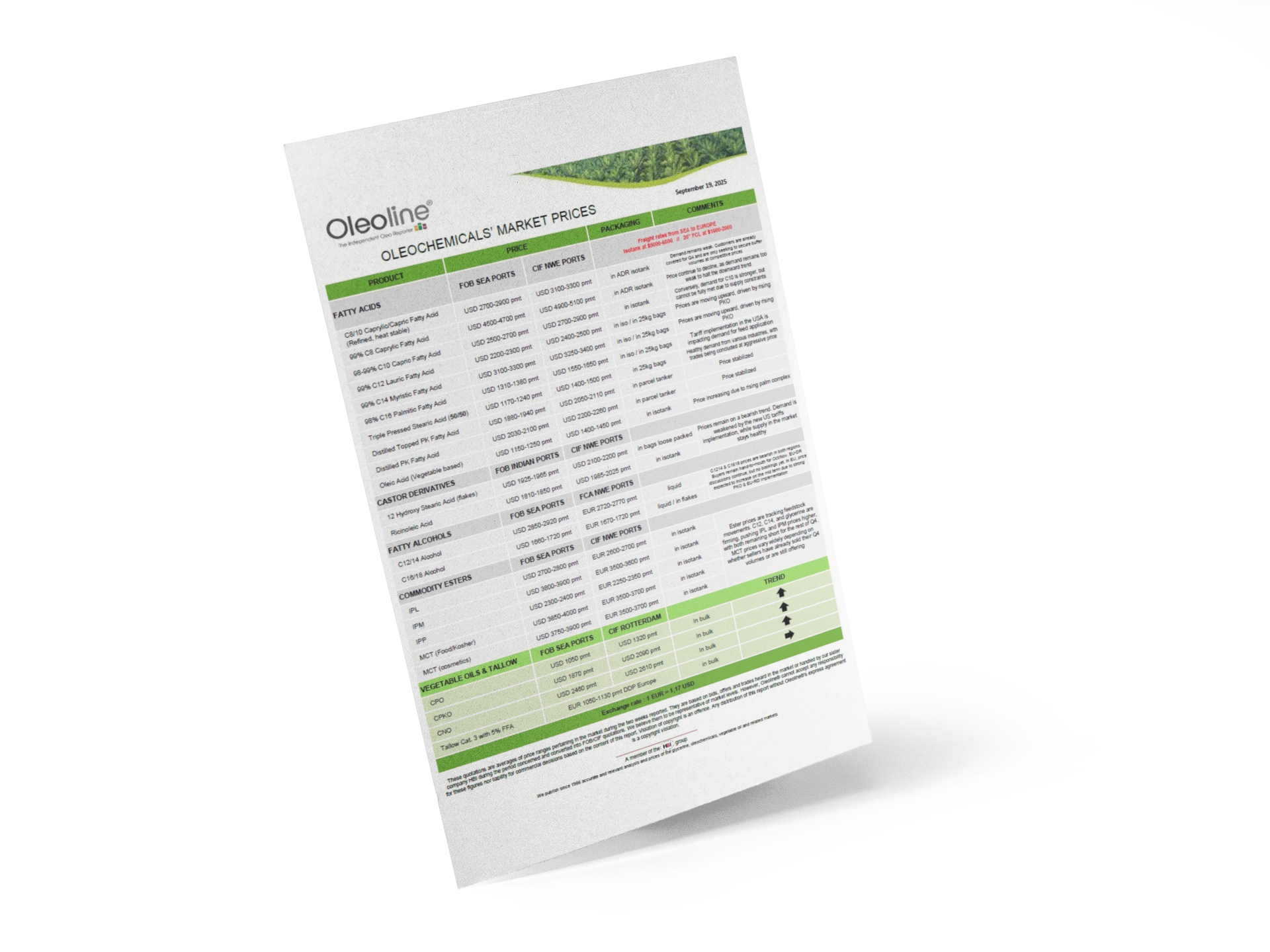

Drawing on HBI’s brokerage activity of 800,000 MT last year and OLEOLINE’s market intelligence capabilities, our objective was to provide a grounded and pragmatic perspective on a market facing increasing structural pressure.

5 key takeaways for 2026

- Access to feedstock remains the primary competitive advantage and the main constraint for producers.

- Elevated oleochemical prices are weighing on demand, particularly in price-sensitive applications.

- Overcapacity continues to exert significant pressure on producers’ margins.

- Trade policies in net-importing countries are delivering limited tangible benefits to stakeholders.

- Value creation is increasingly shifting upstream, towards PALM and PKO sellers.

✔️ While short-term volatility persists, the structural trajectory remains unchanged: oleochemicals continue to establish themselves as a strategic and sustainable alternative to petrochemicals.

🌍 In an increasingly fragmented and fast-moving global environment, HBI and OLEOLINE remain committed to supporting their clients and partners in anticipating market shifts, securing flows, and navigating complexity with confidence.

The discussion continues.

Share this article